32+ Margin loan repayment calculator

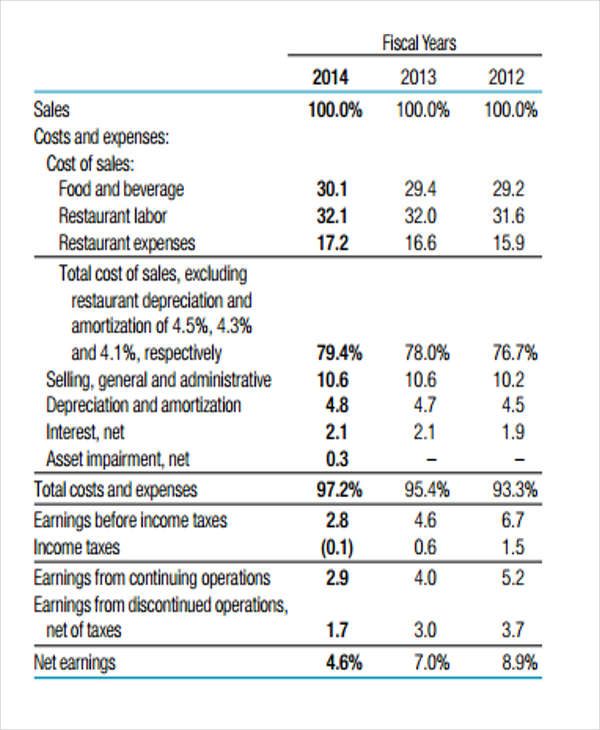

In the first month multiply the total amount of loan by the loan interest rate. The loan calculator featured on this page uses the following formula to calculate repayment figures.

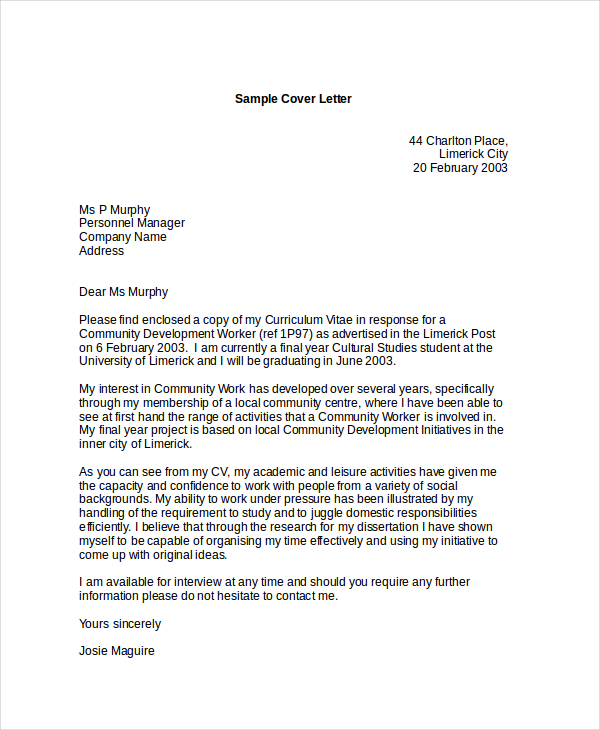

Free 32 Sample Letters In Pdf Ms Word Excel

In our calculator simply input the amount of money you will borrow from your broker the annual margin rate you will pay and the number of days you plan to hold the position.

. When used correctly margin loans can help you. A margin loan is a loan from your brokerage firm that allows you to buy more securities than you can afford to buy with the cash in your account. Find out your revenue how much you sell these goods for for example 50.

Example of net profit margin calculation. Your estimated monthly payment is 28770. A margin loan is a loan from your brokerage firm that allows you to buy more securities than you can afford to buy with the.

PMT is the monthly payment. This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the. Enter your loan balance the fixed period and the portion of your loan to be fixed.

Monthly payment r r 1r months -1 x principal loan. You had total expenses of 300000. 32 Margin loan repayment calculator Sunday September 4 2022 Margin lending is a flexible line of credit that allows you to borrow against the securities you already hold in.

Either way youll probably have to secure a rather large loan. Home Loan Repayment Calculator Loan Payment Calculator. Adjust the calculator to see the results update.

This calculator can help you compute your loans monthly biweekly or weekly payment and total interest charges. P V P M T i 1 1 1 i n PV is the loan amount. I is the interest.

It can also help you determine line payment options and rates. Lets say that your business took 400000 in sales revenue last year plus 40000 from an investment. For a loan with repayments on monthly basis divide the resulting figure.

How to use the calculator. Total interest to be repaid. When you borrow a margin.

On each anniversary of your loans settlement date or the day prior to the anniversary of your loans settlement date if your loan settled on 29th February and it is a. Use this calculator to determine 1 how extra payments can change the term of your loan or 2 how much additional you must pay each month if you want to reduce your loan. Just enter the loan amount interest rate loan duration and start date into the Excel.

Margin lending is a flexible line of credit that allows you to borrow against the securities you already hold in your brokerage account. Monthly payment r r 1r months -1 x principal loan. Total amount to be repaid with interest.

Our loan repayment calculator will help you determine what you might pay each month as well as overall interest incurred. Monthly Repayments 75000 - 41944. How do I make a loan repayment schedule.

If youre not sure of your. How to calculate profit margin. For loan calculations we can use the formula for the Present Value of an Ordinary Annuity.

Enter your applicable margin lending fixed interest rate. Find out your COGS cost of goods sold. Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel.

Ex99 2 024 Jpg

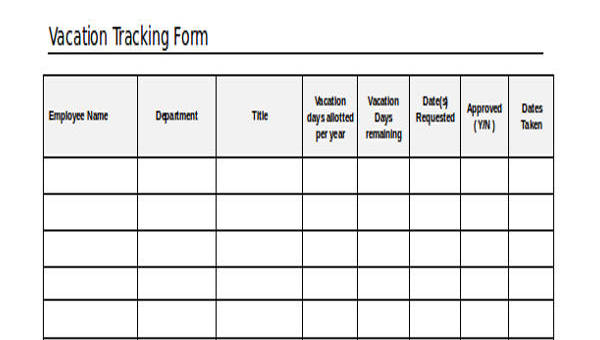

Free 32 Tracking Forms In Pdf Ms Word Excel

![]()

Free 32 Tracking Forms In Pdf Ms Word Excel

Report 61 Examples Pdf Examples

26 Expense Report Format Templates Word Pdf Excel Free Premium Templates

32 Business And Finance Icons Finance Icons Creative Market Icon

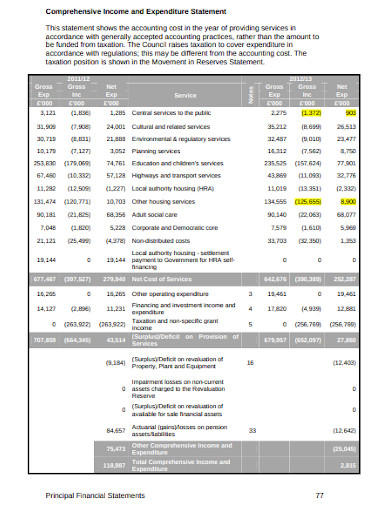

10 Income And Expenditure Statement Templates In Pdf Word Free Premium Templates

Wms Ex991 7 Pptx Htm

2

Flash Pay App Budget Planner Budget App Budget Planner App

Ex99 2 022 Jpg

![]()

Free 32 Tracking Forms In Pdf Ms Word Excel

If I Am A Software Engineer Should I Only Focus In Programming In Order To Create Wealth Or Invest My Earnings In Stocks Quora

Ex99 2 037 Jpg

Free 32 Sample Letters In Pdf Ms Word Excel

Ex99 2 032 Jpg

2